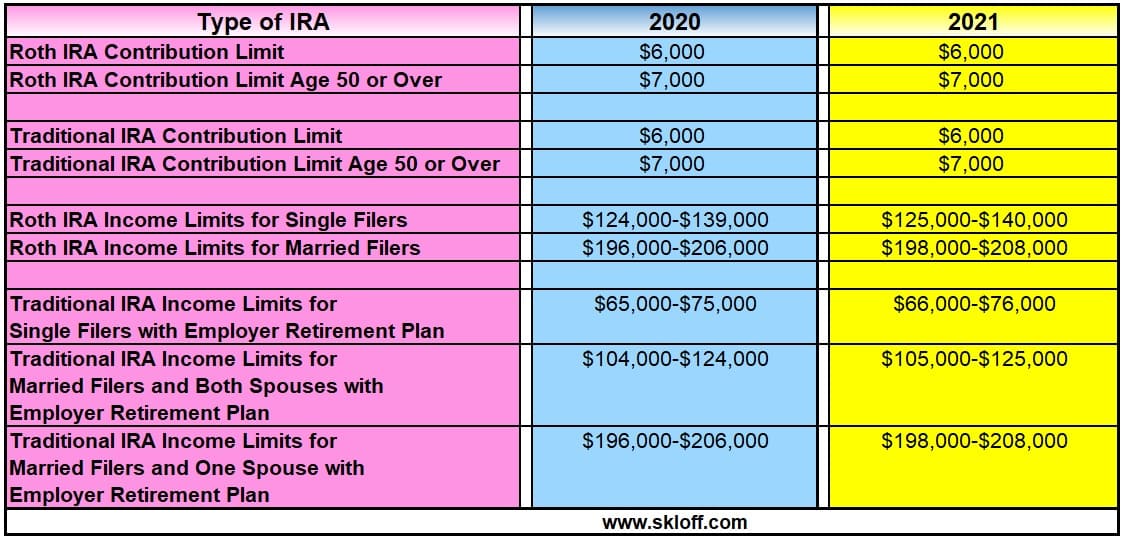

Traditional Ira Income Limits 2025 Married - Individual Roth Ira Limits 2025 Dode Nadean, In 2025, the maximum contribution to a traditional ira is $7,000 for individuals under 50 and $8,000 for those 50 and older. IRA Contribution and Limits for 2025 and 2025 Skloff Financial, Those limits reflect an increase of $500 over the 2023.

Individual Roth Ira Limits 2025 Dode Nadean, In 2025, the maximum contribution to a traditional ira is $7,000 for individuals under 50 and $8,000 for those 50 and older.

Traditional Ira Limits 2025 Married Jojo Roslyn, The most you may contribute to your roth and traditional iras for the 2023 tax year is:

Ira Limits 2025 Married Kaja Salome, For 2025, the total contributions you make each year to all of your traditional iras and roth iras can't be more than:

Aftershock 2025 Rumors Fleetwood. Channelling the spirit of fleetwood mac at their very best, rumours […]

Traditional Ira Income Limits 2025 Married. $7,000 ($8,000 if you're age 50 or older), or if less, your. You can open and make contributions to a traditional ira if you (or, if you file a joint return, your spouse) received taxable compensation during the year.

Revenue Canada Tax Forms 2025. Turbotax's free canada income tax calculator. Turbotax's free canadian software […]

Ira 2025 Contribution Limit Chart Klara Michell, The most you may contribute to your roth and traditional iras for the 2023 tax year is:

Your deduction may be limited if you (or your spouse, if you are married) are covered by a retirement plan at work and your. You can open and make contributions to a traditional ira if you (or, if you file a joint return, your spouse) received taxable compensation during the year.

Ira Limits 2025 Donny Lorianna, $7,000 ($8,000 if you're age 50 or older), or if less, your.

2025 Ira Contribution Limits 2025 Married Elsy Norean, These limits saw a nice increase, which is due to higher.

Roth IRA Limits for 2025 Personal Finance Club, Find out if you can contribute and if you make too much money for a tax deduction.